Pablo de Vicente: New normality 2.0

Updated:

save

In 1933, Roosevelt takes the reins of the United States and develops the first great measures of economic stimulus, the New Deal, to face the «Crac of 29», which brought a deterioration in growth of -45%. From 1933 to 1938, it made an investment of 60% over the average of the GDP of these six years - about 670,000 million current dollars. When it ends in 1938, the GDP had increased by 53% and in 1941, without Roosevelt, it reached 126%.

Already in 2008, overnight, many balance sheets of the financial system were refreshed to zero monetary units. He Mr. Bernanke –President of the Federal Reserve Back then - it had to come to the rescue, as if it were Captain America himself, nationalizing and intervening banks, insurers and greasing the crowded financing markets. It issued its first «quantitative easing» –measures little used, with the reference to the «New Deal» of 70 years ago— for an initial amount of 600,000 million dollars - about 735,000 million today -, 4% of that GDP. Finally, the current 4.37 billion was reached in 2015. A portion of those amounts went to risky assets, doping and inflating them. This anomaly began to be called "new normal". Bloomberg appropriated that christening. But the next phase 2.0 had to be addressed.

With this "new normal" in tow, a backpack of historical world debt, and when even Europe began to show recovery data, we are surprised by the Covid-19.

Again the Federal Reserve of Jerome Powell, –And behind the rest of the central bankers– has had to intervene, providing financing to the system. Along with state aid, the initial amounts reached 2.9 trillion –295% more than the initial impulse of George Bush-. If we add 1.5 trillion in purchases of "repos" to three months in March, the sum would be 4.88 trillion dollars - 25% of the country's wealth in 2019 -, and another one knocking on the door of the Senate and what will haunt you. The Federal Reserve could endorse 4 trillion in loans. All countries have had to establish "similar" plans: the Bank of England, with 745,000 million pounds, 28% of the 2019 GDP; and the European central bank, with 1.35 trillion euros, 11% of the 2019 GDP of the Euro Zone. Here we should add the individual aid from each country.

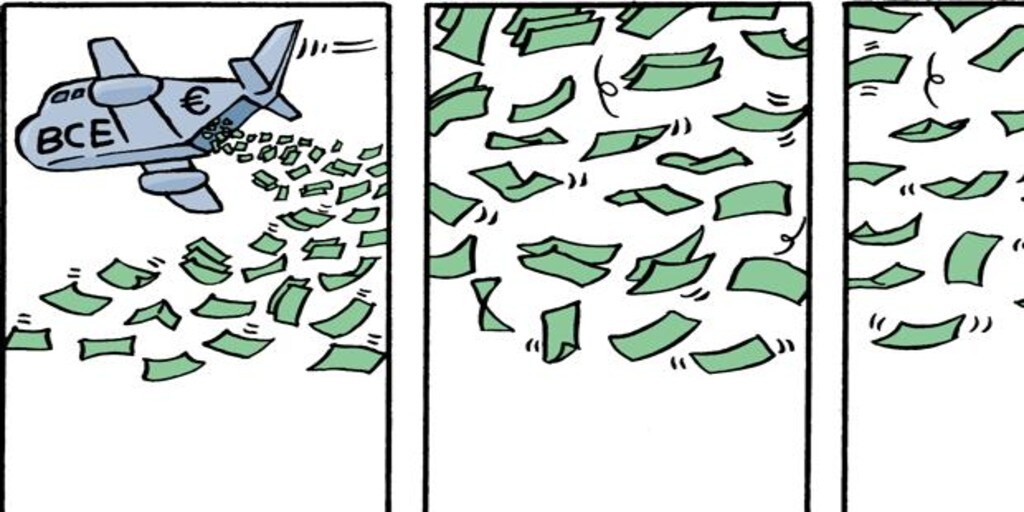

And the mythological helicopter spilling liquidity. In the US, citizens' checks have been remitted: $ 1,200 to adults and $ 500 to minors. And $ 600 a week added to the unemployed. Debt cancellations and "conditional" money gifts will become a reality, especially in those countries with the least political reaction.

Will this debt and deficit overdose be manageable? You will have to deal with it until you reach a point of economic improvement, where you somehow click and try to locate the true normality, in which the assets seek their true value or risk.

The question is that the Covid-19 does not look good, does not swarm near us by a natural route: error, omission or neglect? I do not know. Trump It seems he has more information, even if it is a smokescreen to cover his luminous record highs on his S&P 500, which was driving his reelection until the Covid collapsed him, even with the high, but surprising, levels of unemployment.

In May, the deputy director of the Wuhan Institute of Virology, Shi Zhengli, it made my hair stand on end when indicating that the Covid-19 does not stop being the tip of the iceberg if the necessary means are not put in place to avoid it. These outbreaks could reach devastating derivatives, but make the effort to imagine what it would imply, for example, two more pandemics over the current one. It would take us with experience, but with a recalcitrant economic weakness.

To all this, the risk markets, on the way to their previous or historical maximums, giving a corner to the current objective valuations and betting on a baroque world of flowers. It does not matter, the financial system has been adapting to the roller coaster of markets under the influence of central banks. And a crisis is and always will be an opportunity.

Pablo de Vicente is Financial Advisor and Founding Partner of Evolutio Capital Investment