Housing has soared four times more than wages in the last five years

Updated:

save

More and more Spaniards cannot afford to buy a home and those who rent a large part of their salary bites them. On average, in the last five years, brick has become more expensive in Spain four times more than wages have risen in gross terms - not counting the effect of inflation. In the heat of the economic recovery truncated by the Covid, house prices have increased between 15% and 16%, according to different sources such as Idealista or Tinsa. However, according to the INE wage cost statistics, Salaries have grown on average just 3.8% between 2014 and 2019, a five-year period in which accumulated inflation touched 5%.

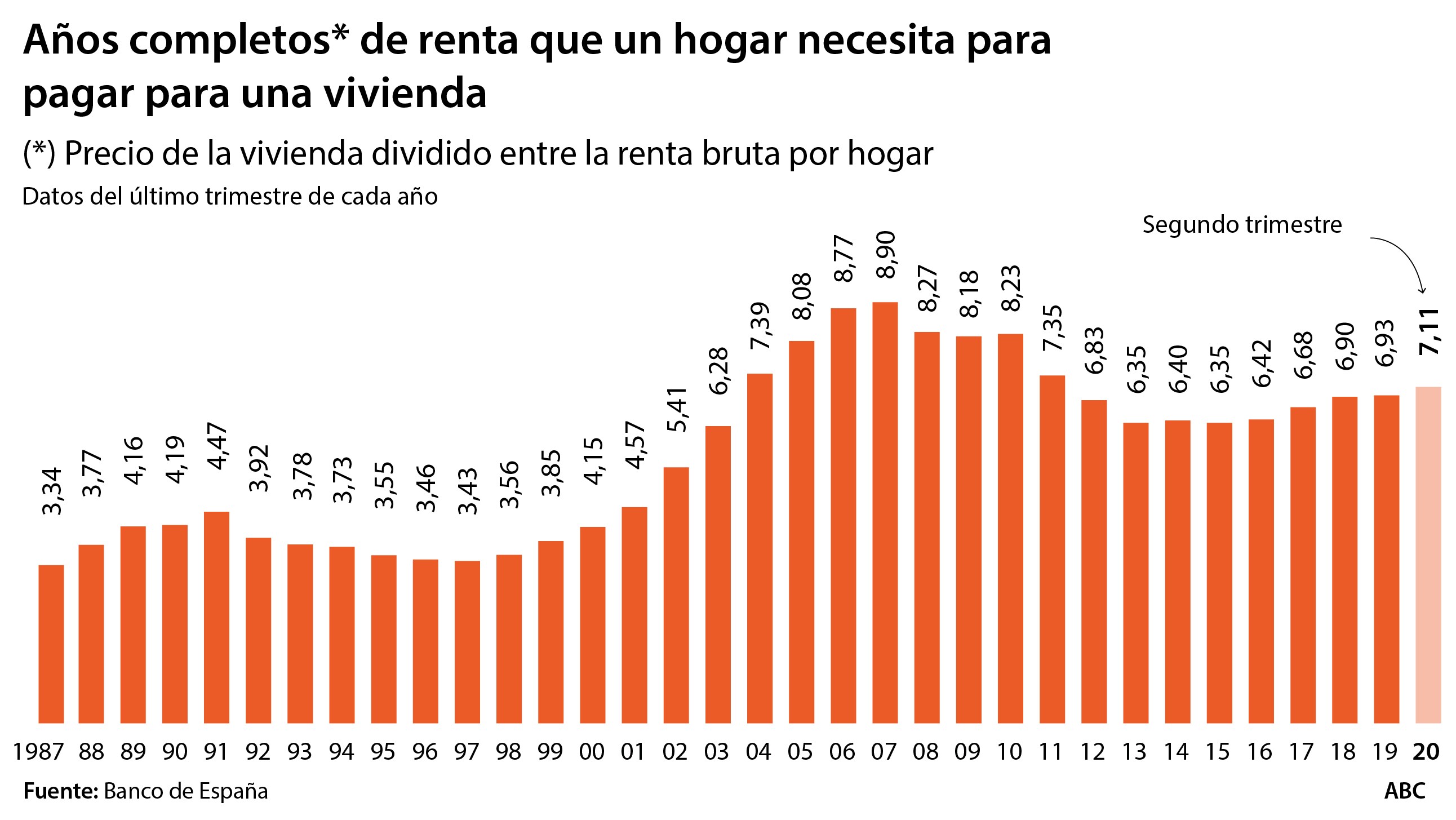

To measure the effort involved in buying a house, the Bank of Spain produces a statistic that divides the price of the property by the gross income of the buying family. That indicates how many years of full rent a household would have to put in to pay for the house. In the second quarter of this year, this ratio was already 7.11 years, at levels similar to those of 2004, when the 'bubble». That is, on average, the purchase of the house now swallows 7.11 years of full income for an average family.

The "Housing bubble" that preceded the 2008 crisis prices shot up. The reduction caused by the crisis alleviated the situation, but did not correct it. Spain has no longer recovered the situation prior to that "bubble": until 2000, the effort involved in buying a home was equivalent to between three and four full years of family income. Now it's almost double than in the 90s.

He high housing prices compared to the salary of Spaniards has become an endemic problem since the "bubble" that led to the 2008 crisis began to fatten. And it has worsened with the expansionary phase 2014-2019: the current effort required to purchase a home is 12% higher than in 2013, on average . The worst cases are in large cities, with Madrid and Barcelona at the fore.

Now it remains to be seen how the housing-wage correlation remains after the impact of the coronavirus. For now, the effect is being more modest in the price of brick than in employment, which has collapsed.

Indigestible rentals

And the problem is twofold, because the rental alternative is expensive. According to the Bank of Spain, the average rental price has climbed to close to 1,000 euros per month, weighed down by the high prices that occur in the most populated cities, with Madrid and Barcelona leading the way. And all this in a country where a third of those who have a full-time job they do not charge more than a thousand euros net per month.

In Spain, for several decades, the price of housing has not kept pace with the labor and wage reality of the country. Now, this is even more surprising in view of the housing stock that continues to exist in our country.

What prevents the price from balancing in the real estate market? "The law of supply and demand works when it is allowed to work, but the housing market is a heavily intervened market," explains economist Juan de Lucio, professor at the University of Alcalá de Henares. In his opinion, the biggest problem is the regulatory framework, the bureaucratic obstacles that prevent the development of buildable land and facilitate residential construction in an agile way. The town councils have the great key to the land, by controlling urban competences.

Causes and effects

But Juan de Lucio points to other causes of the high price level that occurs in the Spanish real estate market. Among them, “the existence of operators that have a lot of financial capacity, which allows them to resist in times of difficulty, acquire assets and maintain high prices for a long time. And, at the individual level, citizens are also very reluctant to lower the price of a house when they put it up for sale, a resistance that they probably do not apply when they divest in other assets or goods. All this makes house prices 'catchy', they move slowly in the supply-demand correlation.

De Lucio explains that the problem of access to housing extends its effects to the economy as a whole: slows down youth emancipation, helps delay the age at which they form a family, impairs birth rates and reduces consumption capacity, because the house swallows a large part of the salary.

The effect of Covid

"Since the pandemic began, we have seen some first adjustments in prices, generally slight at the moment, although significant in specific cases, for example in coastal areas," he explains Rafael Gil, director of the Research Service of the Tinsa appraisal company. But she insists that still It is too early to know how far the effect of Covid will go in the real estate sector, how much prices will fall and if they will do so in less proportion than the economic capacity of households. "We are in an unprecedented situation," says Rafael Gil.

He director of studies of the real estate portal piso.com, Ferrán Font, believes that, for the moment, this fall that is being appreciated in the price of housing «is due, more than to the Covid crisis, to the very dynamics that the real estate market had been accumulating since the autumn of last year, when it began to fall in Barcelona ». "The owners are still reluctant to clearly lower the price", it states. In any case, he is convinced that this downward trend in prices is going to make it a good time to invest in housing from a medium and long-term perspective.

On the other hand, Font considers it urgent that Spain eliminate bureaucratic obstacles and free up public land for the agile creation of housing when there are market tensions. And also apply tax incentives and aid - to supply and demand, in sale and rent - that facilitate access to housing for those who have it more difficult, in the case of young people.